Max Resource issues an update on the acquisition the Floralia Hematite Iron Ore Property in Brazil

Vancouver B.C., June 17, 2024 – MAX RESOURCE CORP. (“Max” or the “Company”) (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2) reports further to its news release of May 16, 2024, hereby provides an update on the purchase of 100% of the Florália Hematite Iron Ore Property (“Florália Property” or “Property”) located 120-km east of the city Belo Horizonte, State of Minas Gerais, Brazil (refer to Figures 1 to 3 and Summary of the Transaction).

On June 5, 2024, the Company received conditional approval from the TSX Venture Exchange ("TSXV") for the Transaction. Final acceptance of the Transaction is conditional upon satisfying the filing requirements outlined in Policy 5.3 of the TSXV Finance Manual.

In accordance with National Instrument 43-101 (“NI 43-101”) the Company has filed an independent Technical Report entitled “Florália Project”, District of Florália, Municipality of Santa Barbara, Minas Gerais, Brazil by Qualified Person (“QP”) Warren D. Robb, P.Geo. (BC) with an effective date of May 29, 2024. The Technical Report is available for review on SEDAR+ (www.sedarplus.ca) and on the Company’s website (www.maxresource.com).

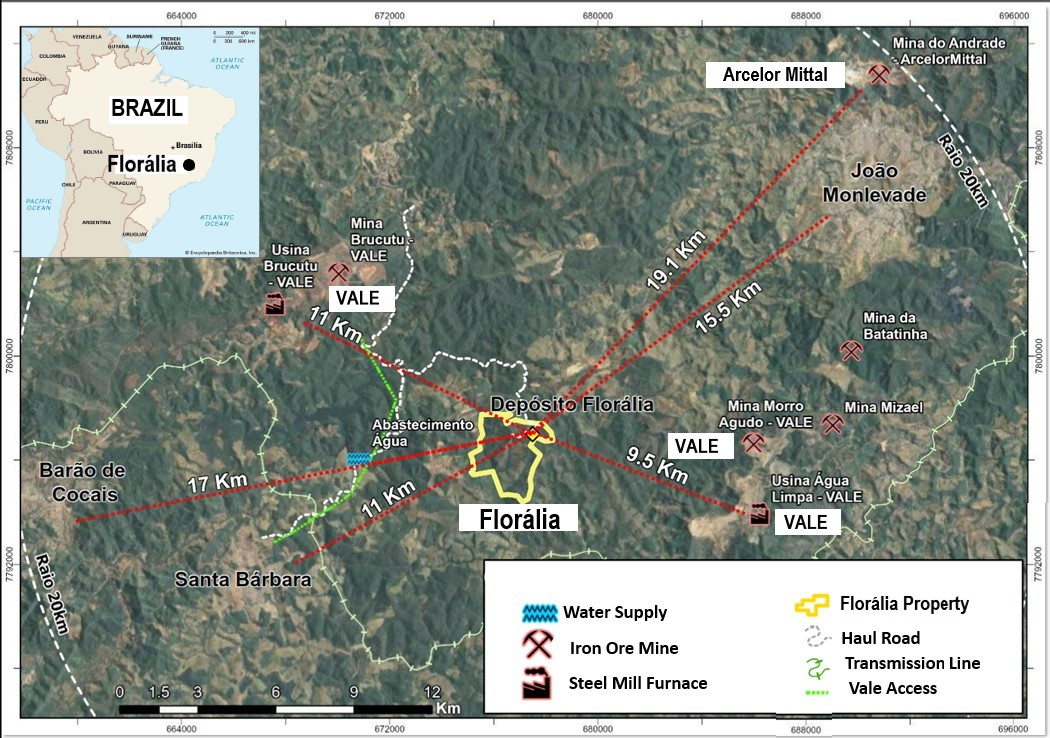

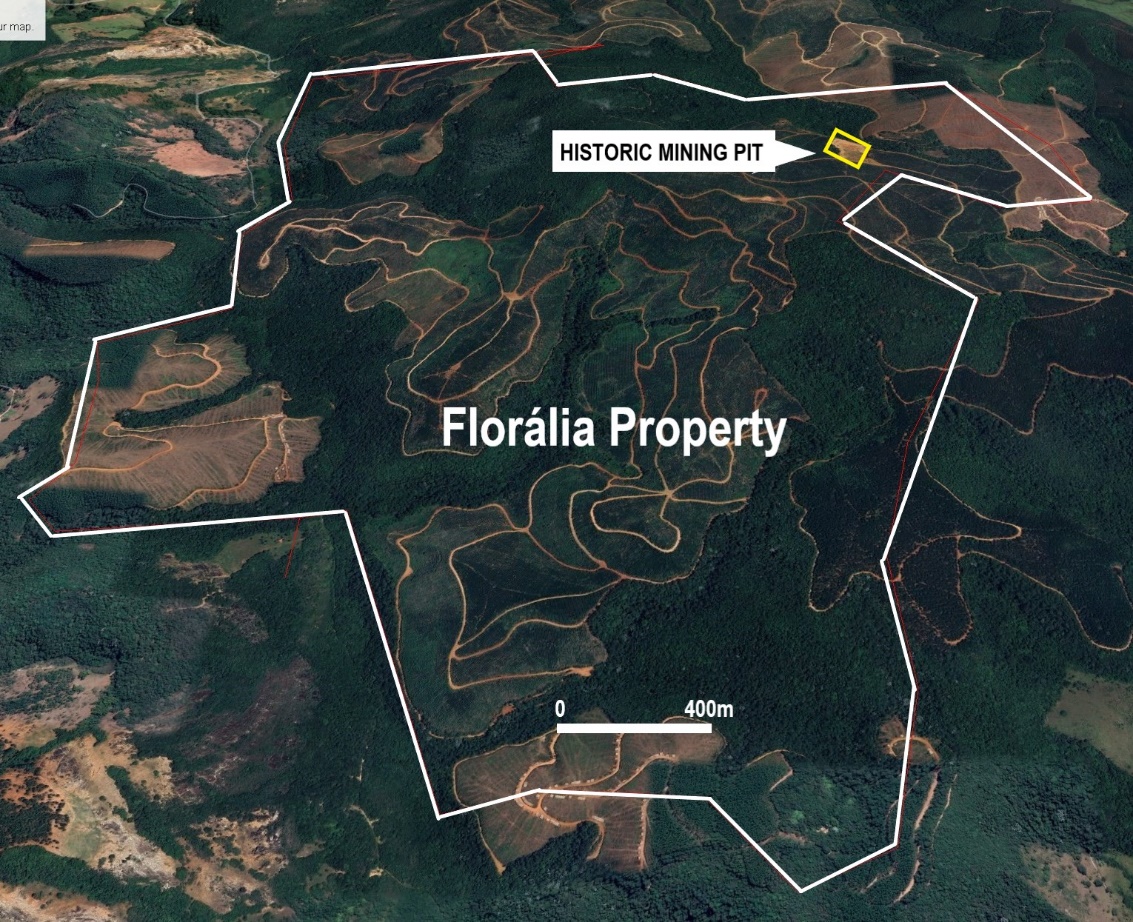

The 613ha Florália Property is situated within the eastern portion of the Iron Quadrangle in Brazil, which hosts some of the largest iron mines in the world.

Channel sampling through the excavated pit exposure was completed in 2023, forty-one channel samples were collected over a 151m accumulated length. This resulted in the definition of a geological target estimated at 2,971,233 m3 to 4,496,333 m3 or 8,052,041 tons to 12,184,160 tons using a density of 2.71 g/cm3 at an average grade of 58% Fe with a 6% LOI.

Max cautions investors the potential quantity and grade of the iron ore is conceptual in nature, and further cautions there has been insufficient exploration to define a mineral resource and Max is uncertain if further exploration will result in the target being delineated as a mineral resource.

The source of the exploration information on the Florália Property is “Depósito Florália Oportunidade para minerrio de ferro by Jaguar Mining Inc.” The document is undated.

Planned exploration in 2024 consists of geophysical and structural mapping programs, followed by drilling.

“Max recently entered into an earn-in agreement with Freeport-McMoRan Exploration Corporation, a wholly owned-affiliate of Freeport-McMoRan Inc. relating to the Cesar Copper Silver Project in Colombia. While our primary focus continues to be the Cesar Project, we seized the strategic opportunity to acquire the high-value Florália Hematite Iron Ore Property,” commented MAX CEO, Brett Matich.

“Florália is known for its iron rich mineral potential and aligns with our long-term exploration strategy. The Property boasts extensive high-grade iron ore mineralization, backed by historical data. We believe this acquisition significantly enhances shareholder value by diversifying our asset base and providing additional pathways and future development potential,” concluded MAX CEO, Brett Matich

Figure 1: Florália Property, major iron ore mines, steel mills, railways, haul roads and mining services

Figure 2. Florália Mineral Claim

Figure 3. Florália “Historic Mining Pit”

Summary of the Transaction

The letter of intent announced by the Company on May 16, 2024, outlines the principal terms for an Asset Purchase Agreement (“APA”) between Max, Jaguar and a wholly-owned subsidiary of Jaguar (together with Jaguar, the “Jaguar Entities”) to purchase Florália Mineral Right n° 832.022/2018 (“Mineral Right”). The parties continue to negotiate the terms of the APA. The Jaguar Entities and Max are arms length parties and, as a result of the transaction, no new insiders or control person will be created. There are no finder’s fees or commissions payable in connection with the Transaction. Max has paid a USD $100,000 non-refundable deposit.

Remaining cash payments:

- USD $200,000 within five business days following the effective date of the APA.

- USD $300,000 within five business days of Max transferring the Mineral Right to wholly owned subsidiary of Max incorporated in Brazil.

- USD $200,000 within five business following the date of 6 months from effective date of the APA.

- USD $200,000 within five business following the date of 12 months from effective date of the APA.

CESAR Copper Silver Project

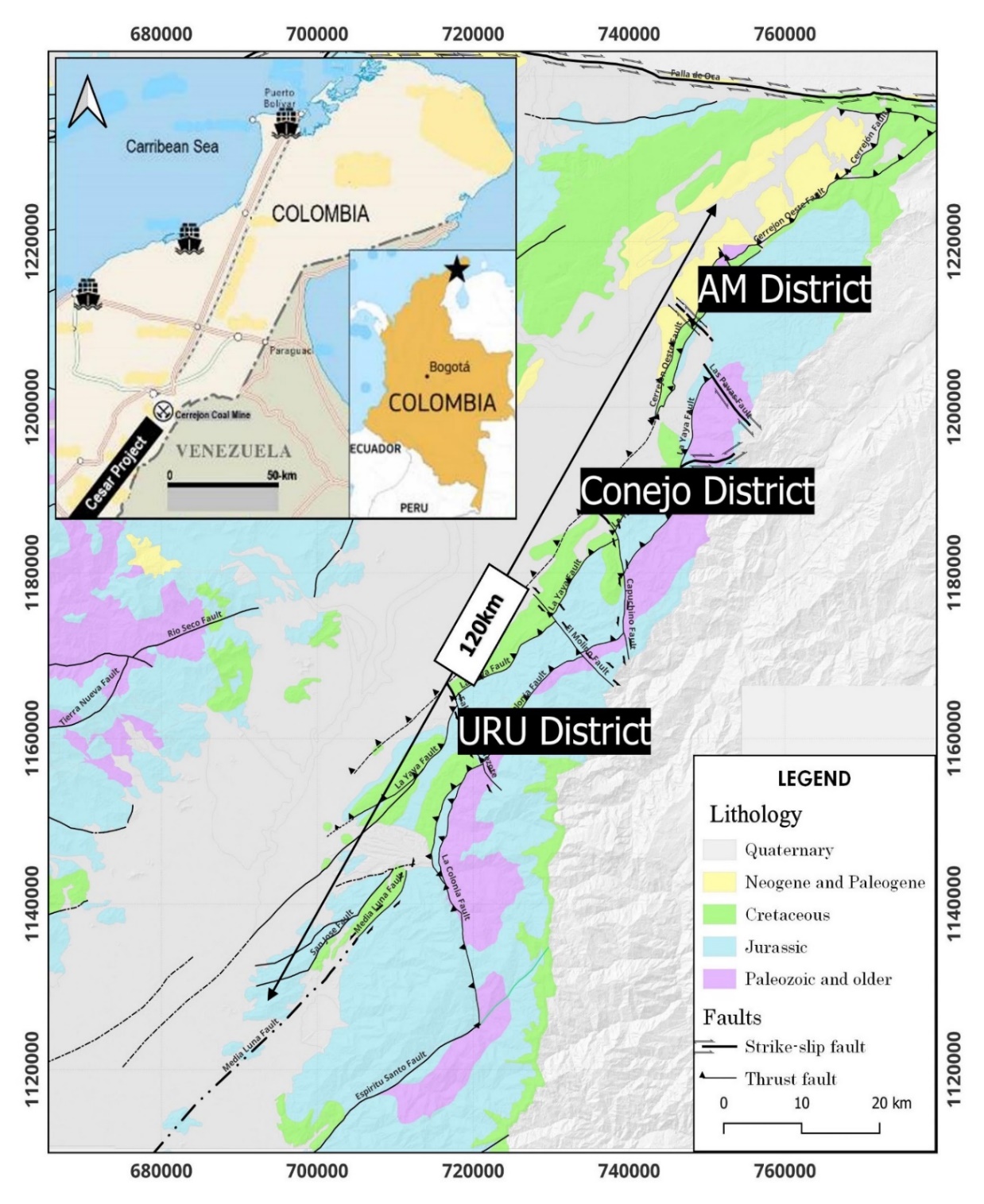

The Cesar Project comprises three continuous districts spanning 120-km, NNE/SSW direction. This region provides access to major infrastructure, including Cerrejón, the largest coal mine in South America, held by global miner Glencore. Max’s twenty concessions collectively span over 188-km² (refer to Figure 4).

Earn-In Agreement with Freeport-McMoRan Exploration

On May 13, 2024, the Company reported that it entered into an Earn-In Agreement (“EIA”) with Freeport-McMoRan Exploration Corporation (“Freeport”), a wholly owned-affiliate of Freeport-McMoRan Inc. (NYSE: FCX) relating to Max’s wholly owned Cesar Copper-Silver Project (the “Cesar Project or Cesar”) in northeastern Colombia. The Company and Freeport are arm’s length.

Under the terms of the EIA, Freeport has been granted a two-stage option to acquire up to an 80% ownership interest in the Cesar Project by funding cumulative expenditures of C$50 million and making cash payments to Max of C$1.55 million.

To earn an initial 51% interest, Freeport is required to fund C$20 million of exploration commitments at Cesar over five years and make staged payments to Max totalling C$0.8 million. Max will remain the operator of Cesar during this initial stage. Once Freeport earns its initial 51% interest, Freeport can increase its interest to 80% by funding a further C$30 million in exploration commitments at Cesar over five years and making staged payments totalling C$0.75 million.

Buyout of Royalties

On November 7, 2023, Max executed a Share Exchange Agreement pursuant to acquiring all the issued and outstanding shares of Bay Street Mineral Corp. (“Bay Street”) an arms length Canadian Corporation in exchange for 14,000,000 common shares in the capital of Max.

Bay Street held an underlying 3% net smelter royalty over 19 mining concessions covering 184-km² and 31 mining concession applications covering 796-km² of the Company’s wholly owned Cesar Project. On November 21, 2023, Max obtained TSX Venture Exchange approval.

2024 Work Program

The 2024 work program in the basin to date consists of stream sediment sampling, soil sampling, rock sampling, surface mapping, extension of the ground magnetics and an Induced Polarization program. This work program is intended to identify and prioritize drill targets.

Max has completed a 10,000-line kilometre airborne magnetic and radiometric survey covering 1,150-km² over all three Districts (AM, Conejo and URU). The data is currently under review with the objective of advancing the Cesar basin model and identifying priority targets.

AM District

Starting in the far north of the Jurassic basin, classic stacked red bed outcrops with extensive lateral continuity have been rock sampled over 15-km of strike. Highlight values of 34.4% copper and 305 g/t silver have been documented in the sedimentary red bed sequences. The Company confirmed that stratiform mineralization continues at depth with two scout drill holes completed in 2023 (Max News Release dated April 4, 2023). In addition, Colombian field crews continue to discover and sample new mineralized outcrops identified AM-1 through AM 14 targets (Max News Release dated May 25, 2023,and Max News Release dated June 22, 2023)

Conejo District

Located approximately 30-km south from the AM District. It is characterized by structurally controlled mineralization, hosted in intermediate and felsic volcanic rocks. Mineralized outcrops have been discovered over 3.7-km at the primary target area. Surface samples averaged 4.9% copper (with a 2% cut-off). No drilling has been conducted to date.

URU District

Located approximately 60-km south from the AM District. Max has identified 12 targets URU-1 through to URU-12. The mineralization of the URU District is hosted in intermediate volcanic rocks and is structurally controlled. At URU-C, a 9.0m of 7.0% copper and 115 g/t silver surface discovery was confirmed at depth by drill hole URU-12, which intersected 10.6m of 3.4% copper and 48 g/t silver. At the URU-CE target, 750m to the east, 19.0m of 1.3% copper discovered in outcrop was confirmed by drill hole URU-9, which intersected a broad zone of copper oxide returning 33.0m of 0.3% copper from 4.0m, including 16.5m of 0.5% copper (Max News Release date January 24, 2023).

Qualified Person

The Company's disclosure of a technical or scientific nature in this news release was reviewed and approved by Tim Henneberry, P.Geo. (British Columbia), a member of Max’s advisory board, who serves as a qualified person under the definition of National Instrument 43-101.

Figure 4: Location and Scale of the Cesar Copper-Silver Project, NE Colombia

About Max Resource Corp.

Max Resource Corp. (TSXV: MAX) is a mineral exploration company advancing the newly discovered, district-scale, Cesar Copper Silver project. The wholly owned Cesar project sits along the northern portion of the Andean Belt, the world’s largest producing copper belt.

The Company also continues to investigate opportunities in the mineral sector.

For more information visit: https://www.maxresource.com/

For additional information contact:

Tim McNulty

E: info@maxresource.com

T: (604) 290-8100

Rahim Lakha

E. rahim@bluesailcapital.com

Brett Matich

T: (604) 484 1230

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law.

Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to the APA, receipt of the TSXV’s final approval, the completion of the Transaction, the Company’s planned exploration programs, the Florália Property, and the Company’s strategy and plans. There are uncertainties inherent in forward-looking information, including factors beyond the Company’s control. There are no assurances that the commercialization plans for Max Resources Corp. described in this news release will come into effect on the terms or time frame described herein.

The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s filings with Canadian securities regulators, which filings are available at www.sedarplus.ca

Back to Past News